Are you interested in finding 'iht case study'? You will find the answers here.

Table of contents

- Iht case study in 2021

- Federal inheritance tax 2021

- Is inherited money taxable

- Iht case study 04

- Iht case study 05

- Iht case study 06

- Iht case study 07

- Iht case study 08

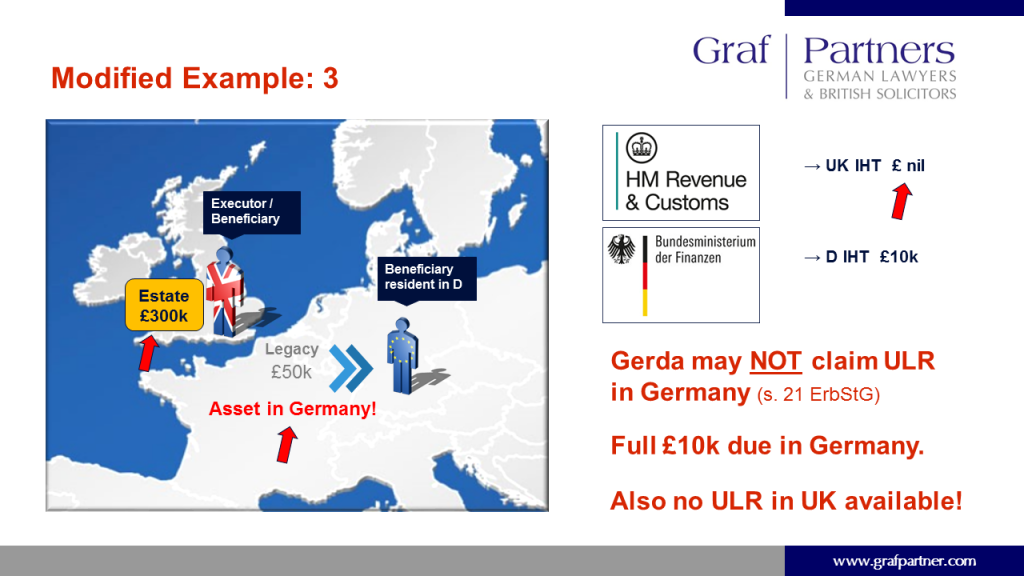

Iht case study in 2021

This image demonstrates iht case study.

This image demonstrates iht case study.

Federal inheritance tax 2021

This picture demonstrates Federal inheritance tax 2021.

This picture demonstrates Federal inheritance tax 2021.

Is inherited money taxable

This image demonstrates Is inherited money taxable.

This image demonstrates Is inherited money taxable.

Iht case study 04

This picture illustrates Iht case study 04.

This picture illustrates Iht case study 04.

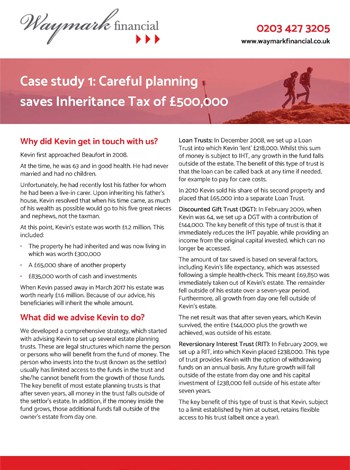

Iht case study 05

This picture shows Iht case study 05.

This picture shows Iht case study 05.

Iht case study 06

This image representes Iht case study 06.

This image representes Iht case study 06.

Iht case study 07

This picture demonstrates Iht case study 07.

This picture demonstrates Iht case study 07.

Iht case study 08

This picture demonstrates Iht case study 08.

This picture demonstrates Iht case study 08.

How are cash flows used in IHT planning?

Using the sophisticated cash-flow modelling software available to me, I established that £100,000 from savings and investments and £8,000 per annum of net income was available for IHT planning without impacting Enid’s current or future lifestyle. The following parameters were used in the cash-flow modelling:

When to use deed of variation for IHT?

Readers with some knowledge of IHT planning may ask why a Deed of Variation (DoV) wasn’t used. A DoV is a means of effectively re-writing someone’s Will post mortem, which, if it is completed within 2-years of death, is effective for IHT purposes.

What is the potential IHT liability on Enid's death?

Based on the figures outlined above, and current legislation, the potential IHT liability on Enid’s subsequent death (assuming it was after July 2018) will be in the order of £394,800, as follows:

Can a Dov be used for IHT purposes?

A DoV is a means of effectively re-writing someone’s Will post mortem, which, if it is completed within 2-years of death, is effective for IHT purposes. In this scenario, the DoV would have given £100,000 to the sons directly from Claude’s Will, using some of his NRB.

Last Update: Oct 2021